The mortgage length that you decide to go with is one of the best financial byproduct of buying a home. Your mortgage term directly influences your monthly payments, how much interest you pay in total and how quickly you’ll own your home free and clear. In this article, we’ll examine the average mortgage length in the U.S., what contributes to it, and how to select the optimal term for your financial goals.

If you don’t feel like studying, please take a listen to this topic on our pod and grab your answer.

How Long Do Most Mortgages Last?

In the U.S., the standard mortgage term is 30 years Its continued popularity stems from the lower monthly payments it affords, which can help make homeownership attainable for millions of Americans. Shorter terms — 15- or 20-year mortgages, for example — are also available and selected by buyers who would like to pay off their homes more quickly, reducing their total interest costs.

Although 30 years is the norm, the truth is that a homeowner generally keeps the mortgage closer to 7-10 years. This shorter term is often due to refinancing, selling the home, or moving to a new home.

Things that Affect Length of a Mortgage

There are a number of reasons for the length of a mortgage:

Interest Rates:

In many cases, shorter loan terms, will provide lower loan rates which mean less payment. But the monthly payments will be bigger.

Financial Goals:

According to potential buyers wishing to keep long-term borrowing as low as possible, they should select shorter terms, but if lowest monthly payments are their highest priority, a longer mortgage would be best for them to choose.

Income and Budget:

Whether you go with a shorter or longer term will depend on how high of a monthly payment you can afford.

Lifestyle Changes:

Life events such as beginning a family, retirement planning or moving may influence how long you keep your mortgage.

Advantages and disadvantages of different mortgage lengths

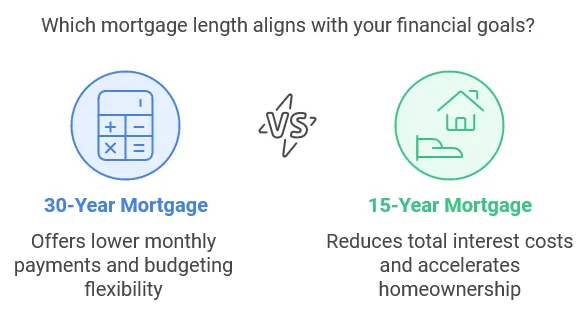

30-Year Mortgage

Benefits:

- Lower monthly payments

- More flexibility in budgeting

Drawbacks:

- Higher overall interest paid

- Slower equity buildup

15-Year Mortgage

Benefits:

- Lower total interest costs

- Faster homeownership

Drawbacks:

- Higher monthly payments

Other Terms of Payment (10 or 20 or custom term):

A few lenders have flexible terms that could give you a compromise between affordability and interest savings.

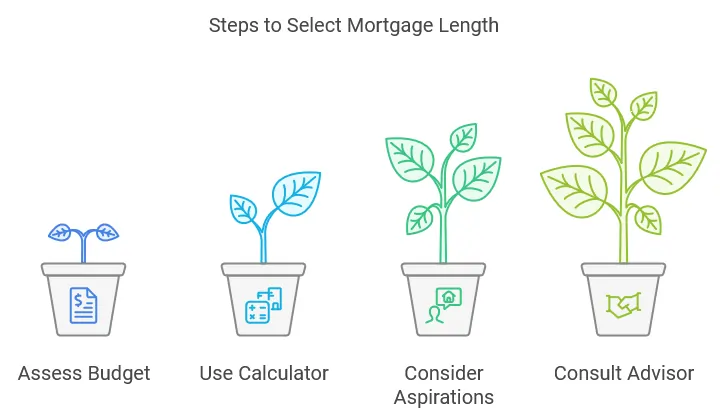

How to Select the Right Length for Your Mortgage

Choosing the best mortgage term varies based on your financial needs and long-term goals. Here are a few steps to help guide you.

- Assess Your Budget:

Avoid stretching yourself too thin – calculate how much, on a monthly basis, you could comfortably afford to pay.

- Use a Mortgage Calculator:

There are online tools out there that can show you payment amounts and total amounts paid over the life of loans with different terms.

- Think About Your Long-Term Aspirations:

Consider how soon you want to pay off your mortgage and if you plan on moving or refinancing in the years ahead.

- Talk to a Financial Advisor:

A mortgage professional can help you weigh your options and select the best term based on your needs.

Acceptance in the U.S. of Such Mortgage Lengths

As interest rates dance around, shorter terms have been getting more attention from homeowners. Refinancing activity has also affected the average length of a mortgage, as many homeowners shorten their terms when interest rates are low. Moreover, increased awareness about financial independence and wealth-building even has some buyers opting for shorter loans, even though the up-front monthly costs are higher.

Conclusion

Selecting the appropriate mortgage term is an important decision that can shape your financial future for years to come. The 30-year term is still the most common, but shorter terms include considerable savings for those who can afford them. With insight into your finances, following the options, and guidance from experts, you can choose a mortgage length that fits your objectives with confidence.

Take the Next Step

Are you ready to check out your mortgage options? Work with an online calculator or trusted lender to determine the right length of path for your dream home.