Submitting the amount of income documentation and inaccuracy of that income documentation when applying for a home loan backed by the Federal Housing Administration (FHA) is one of the most crucial steps you can take in the process. To ensure that such a loan is, in fact, a reasonable risk for the lender, there are standards that borrowers must meet regarding these criteria to provide income and character rehabilitative documentation. So this article covers the income documentation required for FHA loans, what information do you need to be ready?

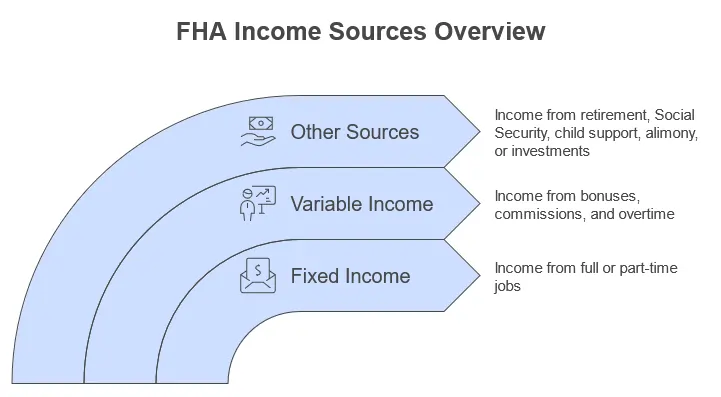

What Types of Income Will FHA Accept?

FHA guidelines are structured to offer flexibility for various income sources, including:

- Fixed Income: Work phund from full or part time Jobs.

- Variable Income: Bonuses, commission, overtime, and seasonal work income

- Other Sources: Retirement income, Social Security income, child support, alimony, or investment earnings

Every income type will need to meet specific documentation benchmarks to be considered.

Documents Required to Verify Income

Here’s what borrowers usually must show in order to meet FHA requirements:

- Pay Stubs: At least the last 30 days.

- Income: Two years of filed tax returns, detailing your entire income history.

- Employment Verification Letter: A formal letter from the employer confirming the borrower’s job status and salary.

- Bank Statements — You’ll provide these to verify direct deposit income and financial reserves.

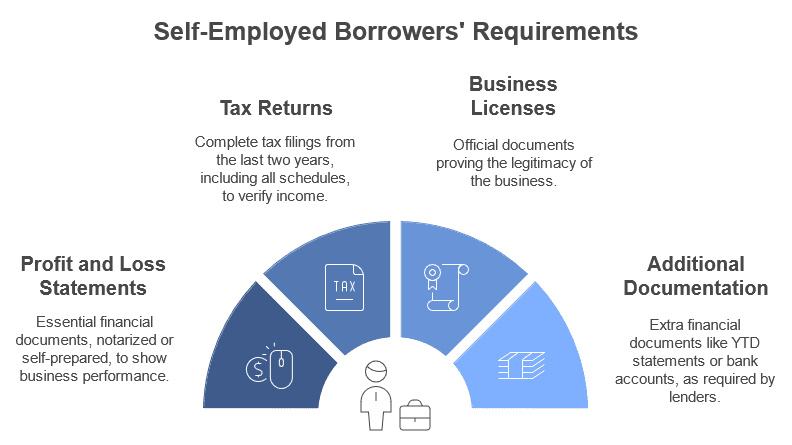

Requirements for Self-Employed Borrowers

There are more stringent documentation requirements for self-employed applicants. They need to provide:

- Profit and Loss Statements: Notarized by an accountant or prepared on your own.

- Tax Returns: Usually the last two years, complete with all schedules.

- Business Licenses or Certifications: This is to verify that they are an actual business.

- Additional Documentation: YTD Financial Statements or Bank Accounts (varies by lender)

Things To Consider In Terms Of Debt-to-Income (DTI) Ratio

The FHA counts income documented in this way to calculate the borrower’s DTI ratio. This ratio looks at how the borrower’s monthly debt obligations compare to their gross income.

- FHA typically likes to see a 31% or lower front-end DTI ratio (housing expenses).

- The back-end debt-to-income (DTI) ratio (total debts) is not to exceed 43%, although exceptions are possible with compensating factors.

To gauge these ratios accurately, proper income documentation is essential.

Common Challenges in Meeting FHA Documentation Requirements

- Seasonal or Irregular Income: Borrowers whose income can vary from month to month may have a challenging time substantiating stability.

- Nontraditional Work: Gig workers or freelancers may have difficulty furnishing enough proof of steady income.

- Missing Documents: Missing tax returns or incomplete employment verification can hold up the loan process.

Borrowers should prepare ahead to tackle these matters by collecting all necessary documentation in advance.

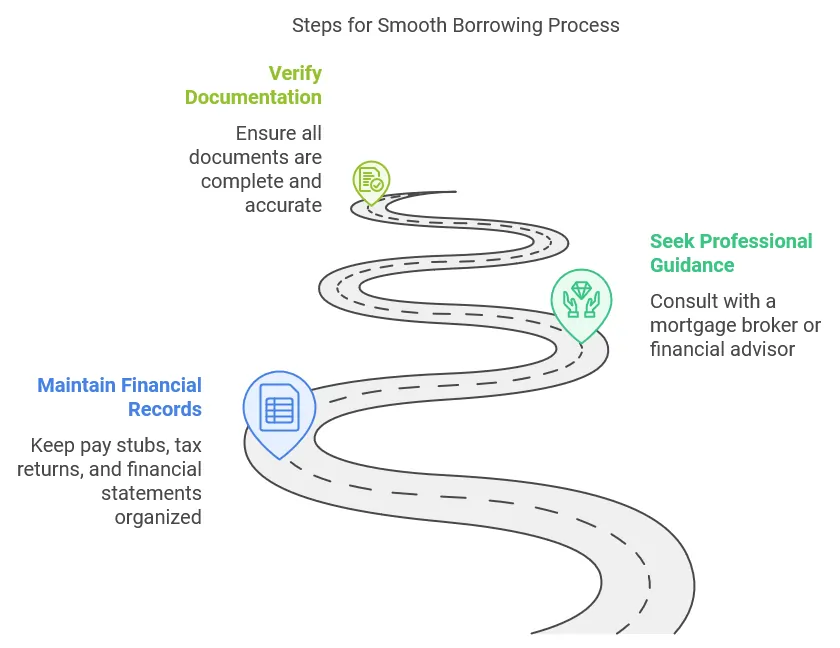

Borrowers Can Do Things to Make It Go More Smoothly

- Analytical: Maintain pay stubs, tax returns, and financial statements.

- Seek Professional Guidance: Consider working with a mortgage broker or financial advisor experienced in FHA guidelinesIssues related to the home or property.

- Verify Documentation: Make sure you have provided all complete and accurate documents to ensure no bottlenecks in your process.

Conclusion

One of the essential parts of an FHA loan is income documentation. Borrowers can prepare the apppropriate documentation and meet the specific requirements so that the approval process is smoother. Whatever your situation, employed, self-employed or other, proactive organisation is your key to victory.

Speak with your lender if you are interested in applying for an FHA loan to confirm the exact documentation you need and get one step closer to your homeownership goals.