One of the biggest financial decisions you’ll make is buying a home. For most aspiring homeowners though the well-need down payment usually proves to be a hurdle. The good news? You can get a home loan with no money down — but, not always. In this article, we will briefly discuss the options, advantages and disadvantages, and practical advice to guide you through the process.

If you are not in a reading mood then no problem! Listen to our podcast for the answer to your question.

What is a no-down-payment mortgage?

No-down-payment mortgages let you borrow for the entire purchase price of your home, meaning you don’t have to make an upfront cash payment. Unlike a traditional mortgage, which requires a down payment (typically somewhere between 10-20% of a home’s value), these loans are meant to help individuals with less in savings achieve homeownership. They also tend to carry certain eligibility criteria and higher long-term costs, however.

No-Down-Payment Mortgage Options

Government-Backed Loans

Government-backed loan programs are the primary way to get a mortgage with no money down:

USDA Loans (United States Department of Agriculture):

To help low- to moderate-income borrowers in rural or suburban areas.

Requirements:

- Property needs to be located in an eligible rural area.

- Borrower’s income must be above certain thresholds

Pros: No-minimum down payment and low interest rates.

VA Loans (Veterans Affairs):

For eligible military service members, veterans and their families only.

Requirements:

- Certificate of Eligibility (COE).

- Minimum service requirements.

No down payment, no private mortgage insurance (PMI), and great terms.

Low-Down-Payment Alternatives

For those who don’t qualify for USDA or VA loans, however, other options can help lower costs at the front end:

- FHA Loans (Federal Housing Administration): Tell you that you can get into a home with as little as 3.5% down, sometimes telling you there are grants or assistance programs that will cover this.

- Conventional Loans (with PMI) — Some lenders permit down payments as small as 3% plus PMI fees.

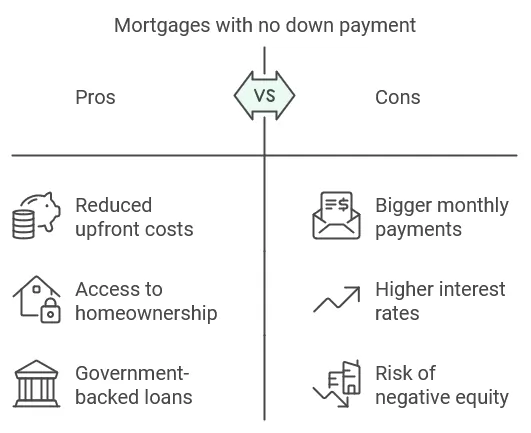

Benefits and Drawbacks of Mortgages with No Down Payment

Pros:

- Reduced upfront costs: You could purchase a home long before you save up for it.

- Access to homeownership: These programs can be particularly beneficial for first-time buyers or those with limited means.

- Government-backed: USDA and VA loans usually offer more competitive terms compared to private lenders.

Cons:

- Bigger monthly payments: When you finance all (100%) of the home’s costs, larger loan amounts mean higher payments.

- Higher interest rates: To compensate for the risk, some lenders will impose elevated rates.

- Downside to negative equity: If home values drop, you can owe more than the home is worth.

Tips For Prospective Borrowers

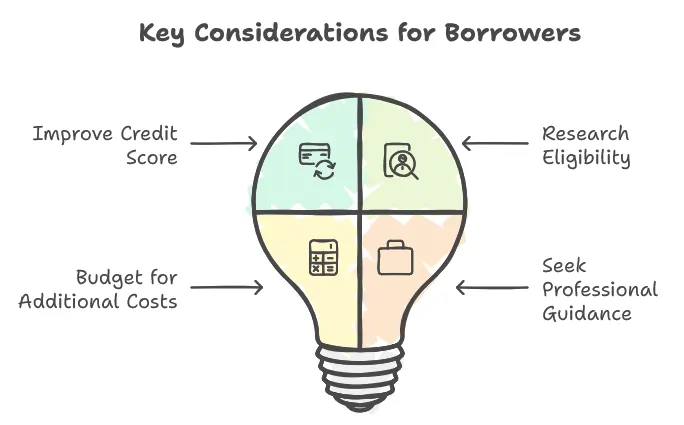

- Improve Your Credit Score

Even with no-down-payment loans, a good credit score helps your chances of approval and better terms. Aim for a 620 or higher for USDA loans and for a 640 or higher for VA loans.

- Eligibility for Research

Some programs, such as USDA or VA loans, have specific requirements based on your income, where the property is located or service history.

- Budget for Additional Costs

Although the down payment might be $0, realize you’ll still owe closing costs, insurance, and taxes.

- Seek Professional Financial Guidance

Quantify your long-term financial wellbeing with a professional who can point you to the most suitable mortgage.

With proper planning and the right resources, it is possible to obtain a home loan with no money down. USDA and VA loans are just some programs that help make the dreams of homeownership a reality for many Americans. But you’ll need to weigh the pros and cons and ensure that your financial health can handle such a major investment.

With a clear understanding of your choices and proactive measures, the path to your own home can be a exciting one. If you’re prepared to begin, reach out to a qualified lender or housing counselor today to discuss the best pathway forward for you.