So, if you’re making $100,000 a year, you may be wondering: How much mortgage can I afford, really? As a mortgage advisor with years of experience working with buyers around the country, one of the most frequently asked questions I receive is, “Which is better, fixed or adjustable-rate mortgages?” Your answer depends on a number of factors — including your debt, credit score, down payment, and geographic location. In this guide, we’ll break down the numbers, scenarios, and strategies so you can understand your buying power with confidence.

If you are not in a reading mood then no problem! Listen to our podcast for the answer to your question.

Quick Answer: What is Mortgage Amount for $100,000 Salary? Average mortgage loan amount: between $300,000 and $500,000 + (with a $100,000 annual salary): Your monthly debts, your credit score, your down payment, your interest rate and now, the deep dive.

Rule of Thumb: 28/36 Rule

The 28/36 rule is what most lenders use to determine how much house you can afford:

28% of your gross monthly income is acceptable for housing expenses (mortgage, insurance, taxes, HOA)

36% is the cap across all your debts combined, not just credit card debt but including car loans and student loans

Let’s break it down:

$100,000 per year = $8,333 per month (gross income)

Mortgage-related costs: 28% of $8,333 = ~$2,333

For debts, $8,333 x.36 = ~$3,000

If you have no other debt, a monthly mortgage payment of around $2,300–$3,000 would be comfortable for you.

What Impacts Your Mortgage Affordability?

1. Credit Score

A higher credit score = lower interest rates = higher affordability.

| Credit Score | Typical Interest Rate |

|---|---|

| 760+ | Best rates (~6.5%) |

| 700–759 | Good rates (~6.8%) |

| 620–699 | Higher rates (~7.5%) |

| <620 | May struggle to qualify |

Tip: Boost your score before applying to unlock better loan terms.

2. Down Payment

The more you put down, the more house you can afford. Here’s an example:

| Down Payment | Home Price You Can Afford |

|---|---|

| $20,000 | ~$320,000 |

| $50,000 | ~$375,000 |

| $100,000 | ~$500,000 |

Also, putting 20% or more down helps you avoid PMI (private mortgage insurance), reducing monthly costs.

3. Debt-to-Income Ratio (DTI)

If you’re carrying car loans, student loans, or credit card debt, it reduces your affordability. Here’s how different debt levels affect your budget:

| Monthly Debt | Max Mortgage Payment | Approx. Home Price |

|---|---|---|

| $0 | ~$3,000 | ~$500,000 |

| $500 | ~$2,500 | ~$425,000 |

| $1,000 | ~$2,000 | ~$350,000 |

4. Interest Rates

Interest rates change your affordability dramatically. Here’s a look:

| Rate | Max Loan You Can Afford (With $2,800/month) |

|---|---|

| 6.5% | ~$450,000 |

| 7.0% | ~$430,000 |

| 7.5% | ~$410,000 |

| 8.0% | ~$390,000 |

Pro tip: Always get pre-approved to lock your rate and boost your negotiation power.

Real-Life Scenarios

🏡 Scenario 1: Low Debt, Good Credit

-

$100K salary

-

$0 monthly debt

-

740 credit score

-

10% down payment

-

Interest rate: 6.75%

💡 You could afford a home around $450,000–$475,000

🏡 Scenario 2: Moderate Debt, Average Credit

-

$100K salary

-

$700 monthly debt (car + student loans)

-

680 credit score

-

5% down payment

-

Interest rate: 7.25%

💡 You may qualify for a mortgage around $350,000–$375,000

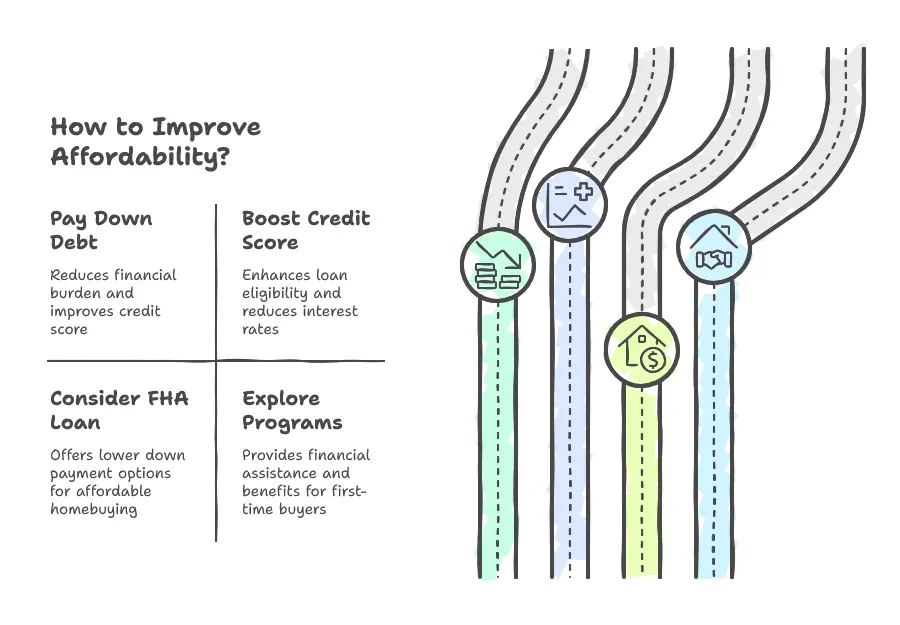

How to Improve Affordability

- Pay down high-interest debt

- Boost your credit score (even 20–40 points can make a difference!)

- If you have a low down payment, then consider FHA Loan

- Check out first-time homebuyer programs in your state

If you are making $100,000 a year, you are in decent shape to buy a house.” In all likelihood, if your financial picture is healthy, you can afford a $350K–$500K home with a monthly payment of $2,200–$3,000.

But don’t forget: Just because you can afford it on paper doesn’t mean it’s comfortable. Always assess your lifestyle, savings goals, and long term plans.

4 Comments

How much mortgage can I afford with 40k salary?

How much mortgage can I afford with 200k salary?

How much mortgage can I afford with 80k salary?

What mortgage can I afford with a 100k salary?