The FHA loan, which is backed by the Federal Housing Administration, allows first-time homebuyers to put a down payment as low as 3.5% since it has more lenient credit requirements. What about if you want to buy land as opposed a to built — in place residence? Can an FHA loan be used that way?

If you don’t have time to read this, listen to our podcast on this topic to hear your question answered!

In this article, we will break down if FHA loans can be used to purchase land, whether any special circumstances might apply for these loans and provide alternatives to financing a vacant lot.

Can You Buy Land with an FHA Loan?

FHA loans are really made to allow folks and families a chance also both buy a home or refinance an current one. Fail to consult with, getting average land does not meet the FHA program.

There is a single exemption you can handle if you are getting acreage to develop the primary house—getting qualified for an FHA building financing. As long as you meet FHA guidelines, this loan even wraps the land and home costs together into one mortgage.

Getting an FHA Construction Loan on Land and Building

If you are looking to buy a piece of land to build a home on, then an FHA Construction-to-Permanent Loan may be the best fit. Here’s how it works:

-

Land and Construction Covered

With this loan, it includes the cost of buying the land and putting up the house.

-

Requirements

- It has to be a primary residence.

- How long the construction work will take,

- You need to work with an FHA-approved lender and builder.

-

Loan Structure

- Graduation of the LoanThe loan will start out like a construction loan during the building phase.

- When construction is finished, it becomes a permanent mortgage and the monthly payment was set every month.

Qualifications for Buying Land with FHA Loans

FHA loans are not available if you are planning to purchase the property for investment, recreational or farming reasons only. For these purposes, other types of financing are perhaps better.

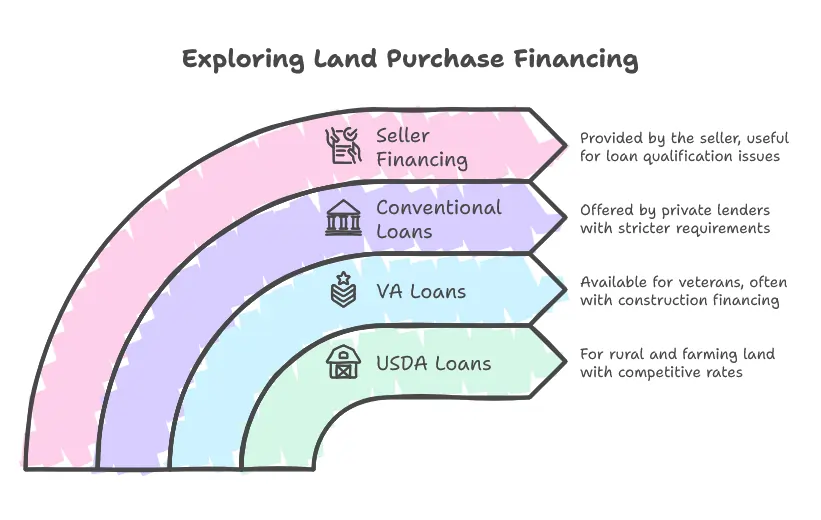

Financing Options to Purchase Land

FHA does not work for you, check out these other options:

-

USDA Loans

- For Rural and Farming Land purchase

- Competitive interest rates; often no down payment necessary

-

VA Loans

- Offer for qualified veterans and military personnel.

- Could be used to purchase land, in conjunction with construction financing.

-

Conventional Loans

- Offered by private lenders.

- Requiring a higher credit score and larger down payment, but with an allowance for different types of land use.

-

Seller Financing

- The financing is provided by the seller.

- This can be an option if you are unable to qualify for a conventional loan.

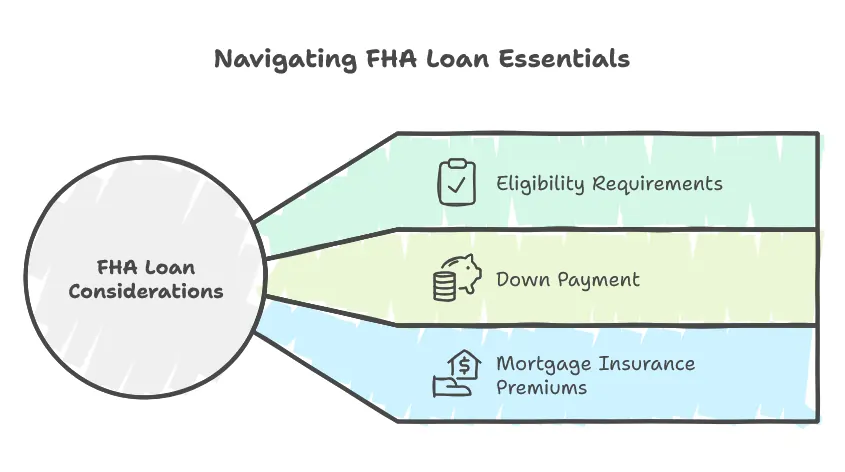

Tips for FHA Loan Applicants

When looking into an FHA loan, be aware of the following:

- Eligibility Requirements: Make sure that your credit score, loan income, and debt-to-income ratio are in compliance with the FHA standards.

- Down Payment: with FHA mortgages the buyer may put as little as 3.5% down

- Mortgage Insurance Premiums (MIP): FHA requires both a similar upfront MIP as as well an annual HUD insuring fee

Conclusion

So, land loans are not a typical use for an FHA loan, but if you plan to build with the same transaction as buying the lot (or are otherwise paying for your own construction), this is what these rules allow. Alternative Financing Options for Land Buyers Looking to Purchase For Other Reasons

Before you do anything, talk to a mortgage broker or financial adviser who can provide advice suitable for your circumstances and perspective on what is best way forward.