For many home buyers, deciding on the right mortgage can dissolve into a swamp of indecisiveness, particularly when interest rates can make or break the cost of a loan. FHA loans comes from part of the Federal Housing Administration, and is a popular choice for many home buyers. But are these loans really offered at a lower interest rate than conventional loans? Here, we’re going to lay out the facts so you know whether an FHA loan is right for you.

If you are not in a reading mood then no problem! Listen to our podcast for the answer to your question.

Comparing FHA Loan Interest Rates

One of the selling points of FHA loans is that they tend to offer competitive interest rates. Such rates tend to be lower than those for conventional loans, especially for those with lower credit scores. That said, FHA loans have extra costs, which could negate the benefits of a lower interest rate.

For example:

- Mortgage Insurance Premiums (MIP): FHA loans have both an upfront and an annual MIP, both of which can add up to thousands of dollars to the total cost of the loan.

- Loan Limits: FHA loans come with borrowing limits that may not cover the cost of housing in higher-cost markets.

- Flexibility for Credit Scores: FHA loans tend to be more forgiving for borrowers with credit challenges, which may help explain why they can deliver lower base interest rates.

In comparison, conventional loans may come with slightly higher rates but do not require MIP if the borrower puts down 20% or more. Though there are trade-offs involved, they are important to understand in making a balanced decision.

Are FHA Loans Right for You?

Though FHA loans may seem more affordable thanks to their low interest rates, they’re not right for everyone. These loans can be a good fit if:

You have a low credit score: FHA loans are intended to assist borrowers with less-than-perfect credit histories access financing.

You’re putting a smaller amount down: FHA loans typically require a down payment at 3.5% or less, perfect for first-time homebuyers.

But if you have a good credit score and can make a larger down payment, a conventional loan may save you more money over time since you can avoid the added expense of mortgage insurance.

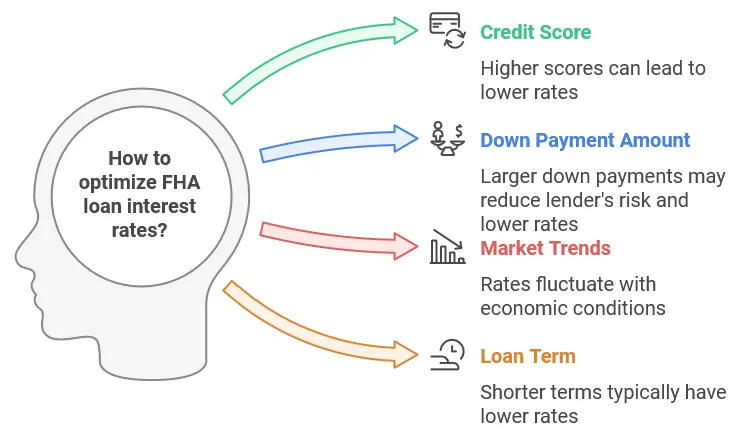

What Impacts FHA Loan Interest Rates

There are a few factors that affect the interest rate you’ll get on an FHA loan:

Credit Score

FHA loans are more lenient when it comes to credit scores, but the higher your score, the more likely you are to get a lower rate.

Down Payment Amount

A bigger down payment sometimes leads to a lower interest rate, since it lowers the lender’s risk.

Market Trends

Like all mortgages, rates for FHA loans move up and down with the broader financial market and the economy.

Loan Term

Longer loan terms (such as 30 years) generally come with higher interest rates compared to shorter terms (such as 15 years).

Conclusion

So, do FHA loans come with lower interest rates? The answer is often yes, especially for borrowers with lower credit scores, or small down payments. On the other hand, FHA mortgage insurance premiums and other associated costs may render them less beneficial than conventional loans in the long run.