FHA Loan Apply process is not only the your determining the creditworthy and financial status. How well does the property you want to buy meet standards established by the Federal Housing Administration (FHA) These FHA Minimum Property Standards make sure that the home is safe, livable, and marketable. This guide will give you the tour through the checklist of these standards, and help you gain insights as a buyer, seller, or real estate professional.

What Are the Minimum Property Standards for FHA?

Minimum Property Standards: These are the minimum guidelines that properties must meet to be eligible for FHA-insured loans. These standards ensure:

- Structurally, the property is sound.

- Every important system and feature works fine.

- All resident living and sleeping quarters are secure and sanitary.

These requirements are there to ensure the home is in good condition and to protect the homeowner and the FHA from unnecessary risk.

Checklist of FHA Minimum Property Standards

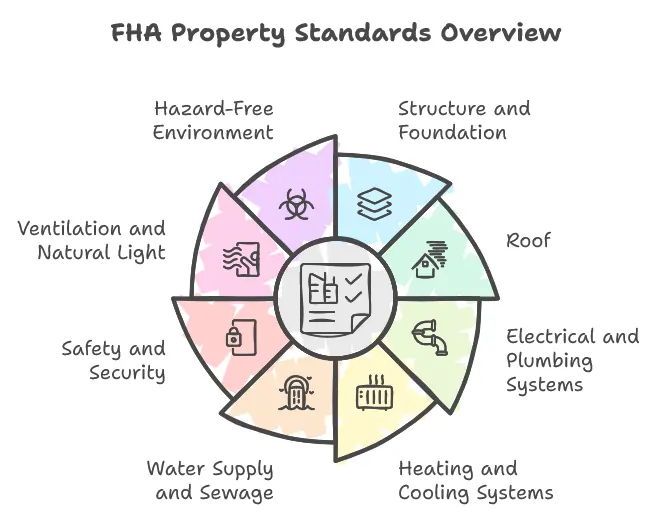

Here’s a summary of the key areas that the FHA’s minimum property standards encompass:

-

Structure and Foundation

The house must be in sound condition with no major visible cracks, no obvious settlement issues, and no signs of major problems.

No major damage or hazards on walls, floors or ceilings.

-

Roof

The roof must have at least two years of remaining life and no leaks.

It is prohibited to have no more than three layers of roofing. If it has three, a new roof must be put on.

-

Electrical and Plumbing Systems

All electrical systems must safely work and contain no exposed wiring.

Plumbing should dispense drinkable water, and work without leaks or stoppages.

-

Heating and Cooling Systems

The heating system should be functional and capable of heating the home sufficiently through the cold months.

If aircon is installed, it should be in good working order.

-

Water Supply and Sewage

Access to safe drinking water and a sanitary sewage system must be provided at the home.

Septic systems, if applicable, must be up to local health department standards.

-

Safety and Security

All locks, doors, and windows should be functional and secure.

The residence can’t have risks such as broken glass or exposed nails.

-

Ventilation and Natural Light

This needs to be done within 24 hours; otherwise, they may cause moisture build-up which is susceptible to mold.

Windows should let in enough natural light in the living spaces.

-

Hazard-Free Environment

The property cannot have environmental hazards, which can include:

- Lead-based paint.

- Asbestos.

- Mold or mildew.

- Toxic chemicals.

Access and Livability

Safe and direct access to the street must be provided for the property.

Kitchens, bathrooms, and bedrooms also must meet minimum size and functionality requirements.

What Is the Criteria for FHA Standards?

FHA doesn’t conduct inspections of properties itself; it depends on licensed appraisers who evaluate the property against these standards. And if the appraiser discovers anything that is not in compliance with FHA standards, the seller is responsible for addressing that issue before the loan can be approved.

Differences Between FHA Standards and Conventional Loans

FHA loans are meant to help first-time and low-to-moderate-income buyers unlike conventional loans. FHA loans come with stricter property standards, which helps to make sure buyers is purchasing a home that doesn’t need expensive repairs immediately after moving in. Conventional loans, on the other hand, generally allow homes to be in “as-is” condition.

Challenges and Insights for Buyers and Sellers

Challenges:

- For Buyers: If the home fails the FHA appraisal, it could delay or prevent purchase.

- For Sellers: Making necessary repairs can be expensive and time-consuming.

Tips:

- For Buyers: Schedule a qualified home inspection before the FHA appraisal.

- For sellers: Have an appraisal inspection done ahead of time and address issues early.

Conclusion

FHA Minimum Property Standards Checklist For Homes Buying FHA Minimum Property Standards Checklist Download Want to Beef Up Your FHA Buying Knowledge? Whether you are facilitating in the sale or brokering their deal, familiarizing yourself with these parameters can make the FHA loan process easier to deal with.

So by making sure your property is up to the FHA standards, you can avoid any delays, save you stress and help realize the dream of home ownership.