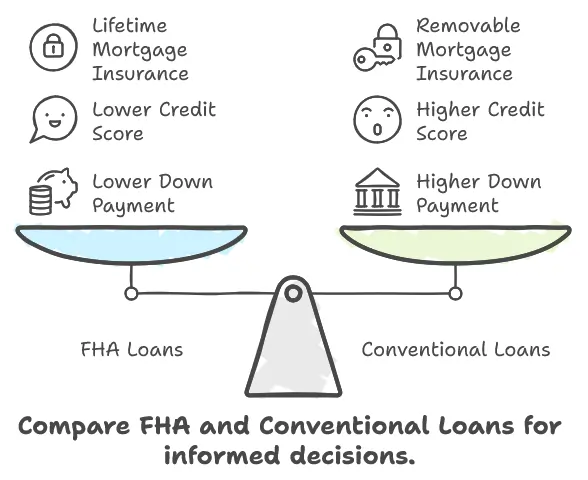

Choosing the right kind of mortgage is one of the most important decisions you make when buying a home. Courageous leads among the common loans options are FHA loans, protected of the Federal Housing Administration, and Conventional loans, which do not have government support. Knowing the basic differences can help you decide which loan best fits your needs and budget.

If you don’t have time to read this, listen to our podcast on this topic to hear your question answered!

What Are FHA Loans?

FHA loans aimed at simplifying the path to homeownership, and are in particular targeted towards first-time buyers or people with limited credit.

Advantages:

- Low down payment: A mere 3.5% is needed.

- Flexibility in credit profile: A home loan can be advantageous to anyone with a score above 580.

- Fixed interest rates: Offer stability during the term of the loan.

Disadvantages:

- Mortgage Insurance Premium (MIP): Required insurance that continues for the life of the loan.

- Loan limits: The largest loan you can get is limited, and these limits vary by area.

What Are Conventional Loans?

Conventional loans are not insured or guaranteed by the government, so they usually require stricter qualifications than FHA loans.

Advantages:

- 20 Percent Down Mortgage with No Mortgage Insurance: Avoid PMI (Private Mortgage Insurance) or REMOVE it later.

- Higher loan limits: Allows room for larger loan amounts.

- Competitive interest rates: Particularly for those with high credit scores.

Disadvantages:

- More stringent credit standards: Typically requires at least a 620 credit score.

- Increased down payment requirements: 5% or more typically.

When Are FHA Loans Better?

- For those with a low score in need of a less-permissive option.

- When you are unable to pay a sizable down payment.

- You first-time homebuyer or have limited savings.

When Do Conventional Loans Take the Cake?

- If you have a good credit score and can qualify under tighter guidelines.

- If you can afford to do a 20% down payment to avoid PMI.

- If you need to borrow larger amounts or get rid of mortgage insurance over time.

Conclusion (FHA vs. Conventional Comparison)

Whether to pick FHA or Conventional will depend on your financial situation and long term goals. FHA loans are more forgiving in general, and good for people with lower credit or down payments. Conventional loans have a lot more flexibilities and savings for borrowers with better financial profiles.

If you are unsure what option is best for you, consider speaking to a Mortgage Broker to clarify your options and help you down the path to homeownership.