As a homeowner, you have financial flexibility, particularly when you can tap into the equity in your home to pay for big expenses. But if you have a low credit score, it can seem impossible to find an appropriate home equity loan. This guide examines high-quality home equity loans available for bad credit, along with the tips and tricks you need to tackle this financial territory.

If you don’t feel like studying, please take a listen to this topic on our pod and grab your answer.

What Is a Home Equity Loan?

A home equity loan enables homeowners to tap into the equity they have built up in their home. Equity is the gap between your home’s current market value and your mortgage balance.

Personal loans often feature fixed interest rates and predictable monthly payments, making them a popular option for larger, one-time expenses, such as home renovations or debt consolidation. Home equity loans, however, are not like Home Equity Lines of Credit (HELOCs); they provide a lump sum of cash up front.

Why Bad Credit Is a Challenge

How Your Credit Score Affects Your Eligibility For A Loan Though low credit scores vary, a poor score — one typically considered to be below 620 — sends a signal to lenders that you might be a greater risk. This often results in:

- Higher interest rates.

- Stricter repayment terms.

- Few offerings from established banks.

But there are lenders who work with consumers with less-than-stellar credit, providing more flexible terms and alternate criteria for qualification.

Key features of bad credit loans

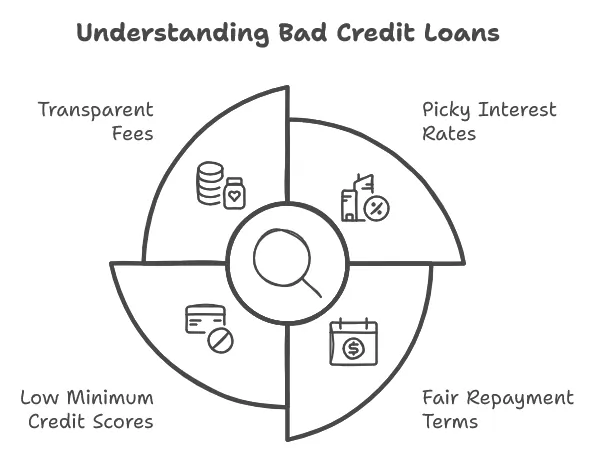

The following key features to look for when looking for a home equity loan for bad credit:

- Picky Interest Rates – Rates may be better than average, but you want to strive for rates not going outside a normal range.

- Fair repayment terms — monthly payments that work for you.

- Low Minimum Credit Scores — Certain lenders only deal with borrowers if scores profiles meet their low minimum requirements.

- Transparent Fees – Be on the lookout for hidden fees, such as origination fees or prepayment penalties.

Top Bad Credit Home Equity Loan Choices

Here are some leading lenders and what they offer to borrowers with low credit scores:

Lender A

Minimum Credit Score: 580

Interest Rates: As low as 8% APR

Features: No prepayment penalties, fast approval process.

Lender B

Minimum Credit Score: 550

Interest Rates: From 9% Variable APR.

Pros: Flexible terms, high LTV ratio

Lender C

Minimum Credit Score: 600

Interest Rates: Starting Fixed APR 7.5%

Features: No hidden fees, focus on borrowers with significant home equity.

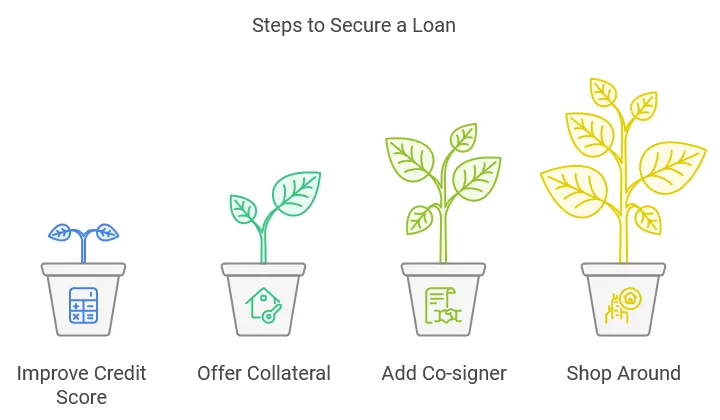

Ways to Increase Your Chances of Getting Approved for a Loan

If you have bad credit, there are things you can do to improve your chances of getting a home equity loan:

- Improve Your Credit Score — Paying off existing debts and reviewing your credit report for mistakes can help increase your score.

- Offer Collateral – Offering extra security may lower the risk to the lender.

- Add a Co-signer – If you get a co-signer, this person with excellent credit can help you qualify for better rates.

- Shop Around – Get offers from different lenders to see what they’re willing to give you.

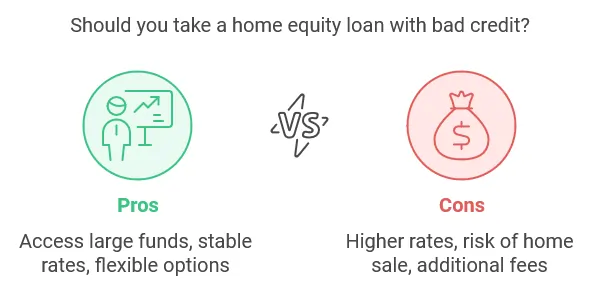

Home Equity Loans for Bad Credit: Pros and Cons

Pros:

Access to large amounts of money with home equity.

Stable interest rates and fixed payments.

Borrowers with poor credit can get flexible options

Cons:

Interest rates higher than conventional loans.

You may have to sell your home if you can’t pay it off.

Other fees and costs may apply, as well.

To get the best home equity loan with bad credit, you’ll need to do your homework and be diligent. With knowledge of your options and the necessary steps to compare lenders and improve your credit profile when possible, you can get a loan that works for you without ruining your financial future.

If you are taking on this debt as your first loan, take your time to read all the fine print and do not hesitate to ask questions and consult with financial advisors when necessary. Your home is one of your largest assets so use its equity wisely.