Mobile homes (known to some as manufactured homes) are a growing housing option because of their affordability and flexibility. On the flip side, financing a mobile home comes with its own set of challenges, not least of which is interest rates. In this article, we’ll discuss what influences the average mobile home interest rate, how they differ from mortgage rates for houses, and strategies for getting better terms.

If you don’t feel like studying, please take a listen to this topic on our pod and grab your answer.

What Are Mobile Home Loans?

Mobile Home Loans are loans for the purchase or refinance of manufactured homes. These loans are different from traditional mortgages due to the fact that mobile homes are often considered personal property rather than real estate. The impact of this distinction is felt most strongly in the interest rates offered.

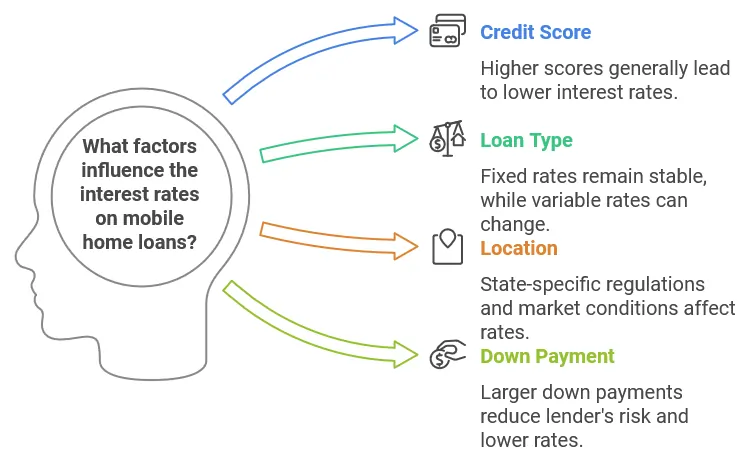

What Factors Influences Interest Rates on Mobile Homes

Interest Rates for Mobile Home Loans Depend on this Factors:

-

Credit Score:

A borrower’s credit score is one of the biggest elements determining loan terms. In general, the higher a score the lower the interest rate.

-

Loan Type:

Mobile home loans may offer either fixed or variable interest rates. Fixed rates stay the same for the life of the loan, while variable rates can move when market conditions change.

-

Location:

Availability and cost of mobile home financing are often dependent upon state specific regulations and market conditions.

-

Down Payment:

A higher down payment lowers the lender’s risk and generally comes with lower interest rates.

-

Age and Type of Home:

Financing more recent or permanently attached mobiles usually have better rates than older or non-permanently attached units.

Average Rate on Mobile Home

As of 2024, mobile home loan interest rates are typically between 6% and 12%, depending on the creditworthiness of the borrower, loan type, and lender. The rates are typically higher than those for traditional mortgages and reflect apprehended risk factors with mobile homes.

All You Need to Know About Mobile Home Loan Rates

Mobile home loans tend to have higher interest rates compared to traditional loans because they are structured differently and are classified as personal property rather than real property. Traditional mortgages usually have rates from 5% to 7%, which is much cheaper in the long run.

All You Need to Know About Mobile Home Loan Rates

Mobile home loans tend to have higher interest rates compared to traditional loans because they are structured differently and are classified as personal property rather than real property. Traditional mortgages usually have rates from 5% to 7%, which is much cheaper in the long run.

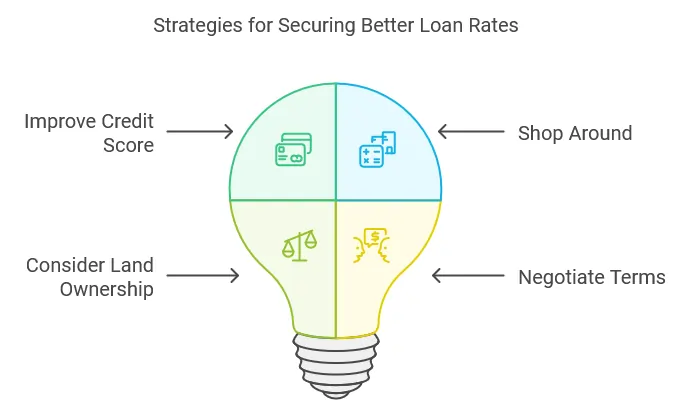

How to Secure the Best Interest Rates

Prospective borrowers can do the following to help cut costs:

Improve Your Credit Score:

Reducing debt and never paying late can make a big difference in your score.

Shop Around:

It is imperative to compare offers from several lenders, which can include banks, credit unions, and specialized mobile home financiers.

Consider Land Ownership:

Lenders may offer you better rates if you own the land where the mobile home sits.

Negotiate Terms:

Negotiate: Don’t be afraid to haggle, whether that’s on the loan terms (interest rate, fees and repayment term).

Challenges and Opportunities in Mobile Home Financing

Mobile homes can be an affordable housing option, but financing a mobile home can cost more because mobile homes often come with higher interest rates and fewer lenders willing to provide financing. Growth in affordable housing demand may lead to new policies and financing innovations that will provide lower-cost access.

Conclusion

Determinants of Mobile Home Interest Rate The average interest rate for a mobile home With proper research and preparation, a mobile home borrower can be approved for a loan with good terms and enjoy the benefits of mobile home living.

To see the most accurate and current information, always check with a financial advisor or lender-specific offers (those not included in the table above).