Especially due to the added luxuries of home is what the several motorhomes available on the market make these the new wave of travel. But due to their steep price tag, most buyers resort to loans to cover the cost. Motorhome loans have their own rules and conditions, especially about the duration of the loan, unlike traditional mortgages or car loans. Getting to know the length of these loans and what determines the duration of the loan is relevant when considering motorhome financing.

For those of you who’ve little desire to read, join the topic on our podcast here to find your answer.

Typical Duration of Motorhome Loans

Motorhome loans are usually for one of the term ranges of 10 to 20 years. A loan’s term length varies depending on factors such as the motorhome’s price, the applicant’s creditworthiness and the lender’s policies.

Loan terms for newer motorhomes are typically longer, anywhere from 15 to 20 years for new models — especially high-end ones. It allows buyers to have lower monthly payments but leads to higher total interest payments over the life of the loan.

In contrast, used or older motorhome loans are typically for a much shorter period (around 10 years or less)due to the depreciation of the vehicle. Also, because used RVs are often older and might not be in good condition, loan terms are not typically extended as far out for used models.

However, motorhome loans are typically classified as secured loans, which means the vehicle itself acts as collateral, unlike traditional home or auto loans. This may affect both the term of the loan and the rate of interest.

How Long Does a Motorhome Loan Usually Take?

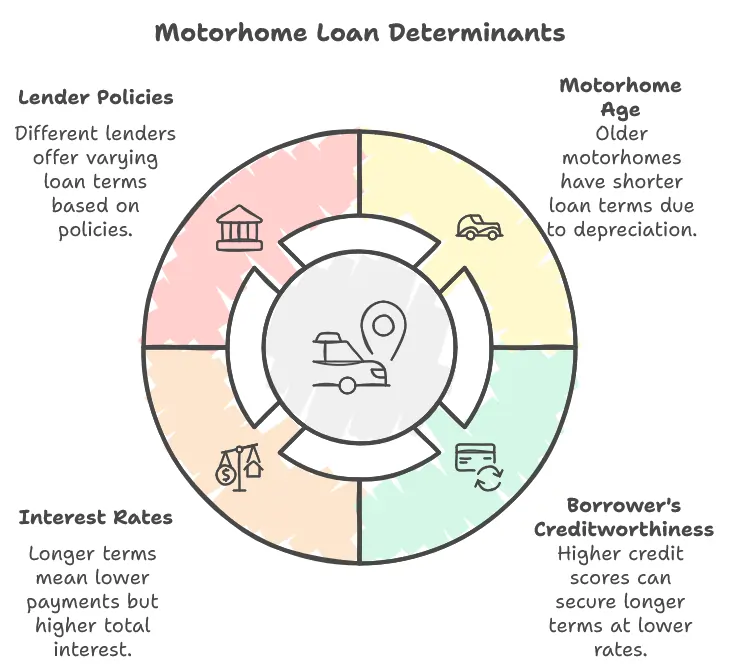

- Motorhome Age: The age of the motorhome is one of the most important factors in determining the length of your loan. In addition, lenders tend to offer longer loan terms for new or newer motorhomes since they depreciate slower than older units. Most older motorhomes (typically, those over 10 years old) have restricted loan terms due to depreciation.

- Borrower’s Creditworthiness: Your credit score is one of the most important determining factors in your loan term. Higher creditscore borrowers (700+; men) can gilt edge longer loan terms at below-market interest rates. People with lower scores may also get shorter terms or higher rates, leaving long term loans more expensive overall.

- Interest Rates: The rate of interest on the loan determines the duration too. Longer loan terms generally translate to lower monthly payments but higher total interest costs. Shorter terms, on the other hand, usually come with higher monthly payments but lower interest paid over the life of the loan.

- Lender Policies: Not all lenders operate the same way. Some lenders provide loans with terms of up to 20 years for old motorhomes, but others restrict loans to 10 or 15 years based on their risk appetite, lending capabilities and the amount of motorhome. Shopping around for offers from different lenders can help you secure the most favorable loan term.

Comparison with Other Similar type of Loans

Motorhome loans are different from car loans and home loans in several ways, most notably the loan length, interest rates, and qualification requirements.

- Car Loans: Car loans typically have shorter terms than motorhome loans, ranging from 3 – 7 years. That’s because cars lose value much faster than motorhomes do, and motorhomes can be a more long term investment. Car loans are generally less than and therefore shorter than home loans.

- Home Loans: The terms of home loans are usually much longer, often covering 15 to 30 years, due to the appreciation in real estate and generally much larger loan amounts. Motorhome loans, on the other hand, are typically lower amounts and seen as higher-risk assets by lenders because they depreciate.

- Motorhome Loans: Motorhome loans fall kind of in the middle. For newer models, they can be up to 20 years, but they generally come with a higher interest rate than home loans. In addition, motorhome loans are classified as “personal property” loans and are not secured as real estate loans, resulting in different terms and conditions.

Longer Vs. Shorter Loan Terms: Pros & Cons

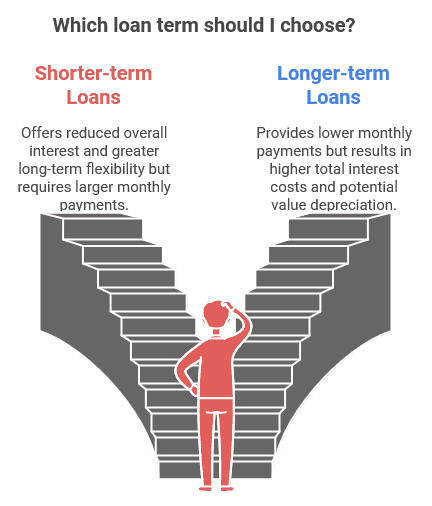

The right loan term for you will depend on your finances and future goals. Here are some of the advantages and disadvantages of choosing a longer or shorter loan term:

Shorter-term loans (10 years and less)

Pros:

Reduced overall interest rate payments.

Such a loan is paid off much sooner, offering much greater long-term financial flexibility.

Cons:

Bigger monthly payments which may leave your budget squeezed.

Ought not be inexpensive for people who are getting paid with little monthly wage.

Longer Loan Terms (15 -20 years)

Pros:

Lower monthly payments; more affordable per month

Great for buyers who wish to keep their monthly payments affordable.

Cons:

Total higher interest costs over the life of the loan.

The motor home may lose value faster than the loan is paid down, leaving you owing more on the vehicle than it is worth (this is called being “upside down” on the loan).

Important Considerations When Choosing a Loan Term

The decisions to be made before signing a line for a motorhome would include:

- Assess Your Financial Situation: Review your monthly budget and consider how much money you can comfortably afford to pay toward your loan. While a shorter term will give you higher monthly payments, just ensure you can afford for the increase without stretching your finances too thin.

- Think about the Total Cost: Although longer terms can decrease monthly payments, they can also increase the total interest paid. Be sure to compute the total cost of the loan over its life to know how it will affect your finances.

- Seek Advice from a Financial Advisor: If you’re uncertain whether you should go with a shorter-term or a longer-term loan, you might want to consider speaking with a financial adviser. They can help you figure out how much you can borrow and if a longer or shorter term is the right option for you.

Motorhome loan terms typically range between 10 and 20 years, depending on the age of the motorhome, your credit score, interest rates, and lender policies. Do you plan on staying in your new home long term, or will you eventually sell it, and how does that affect the pros and cons of different loan terms? The right motorhome loan duration can help you have peace of mind, as long as you know how to find the right one for you!

Just as a note, only choosing a loan term that has the lowest monthly payment ever, doesn’t equate to the most affordable for your overall budgeting AND long-term financial health.