A lot of homeowners are actually in a financial bind with no hope of universal bank loans because they have low credit scores. The problem can be especially troubling when repairs to the home are needed but aren’t affordable. For those in situations like these, home repair loans for bad credit are built to help people make needed repairs as well as keep up their homes. This article covers what these loans are, how they work, what challenges the borrowers encounter, and the options for borrowers with bad credit.

If you don’t feel like studying, please take a listen to this topic on our pod and grab your answer.

What Are Home Repair Loans?

Home repair loans are targeted loans you can take out to cover home maintenance and improvements. These are different from other types of loans like a personal loan or a mortgage, which only cover bad expenses. These repairs can be anything from structural to basic plumbing or electrical systems updates. It may feel tough to acquire these loans for people with poor credit, but there is help available.

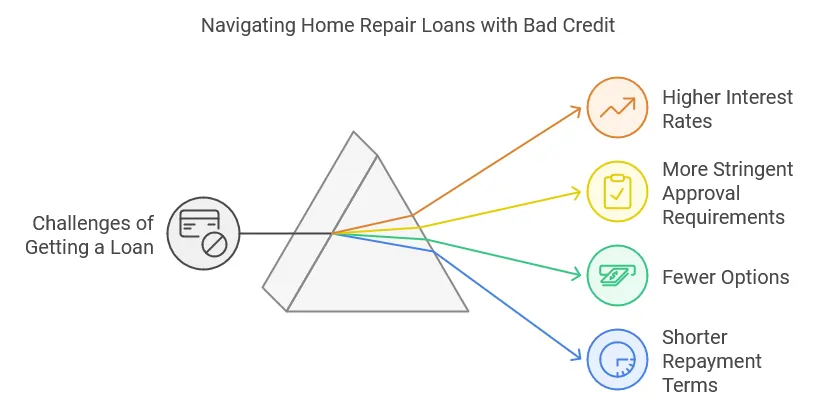

Get a Loan with Bad Credit: the Challenges

Significant Barriers To Home Repair Loans For Those With High Debt or Bad Credit These include:

- Higher Interest Rates: Individuals with bad credit may have to pay two to three times the interest of someone with good credit. That is because lenders see them as riskier borrowers.

- More Stringent Approval Requirements: Lenders often have more stringent criteria for applicants with bad credit, requiring them to have higher incomes or larger down payments.

- Fewer Options: The pool of lenders is smaller, as a lot of traditional financial institutions do not give home repair loans to people with bad credit.

- Shorter Repayment Terms: Bad credit loans may be for shorter periods of time, meaning bigger monthly payments.

However, there are still options available for people with bad credit to obtain funds for home repairs, despite this adversity.

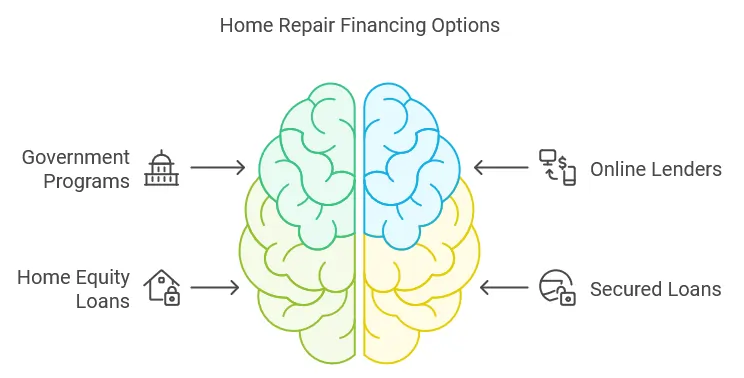

Options and Resources for Individuals with Poor Credit

Here are some options for bad credit home repair loans:

- Government Programs: Some government programs (like U.S. Department of Agriculture (USDA) or the Federal Housing Administration (FHA)) offer loans or grants to low-income homeowners needing to repair or improve their homes. Eligibility requirements tend to be more lenient and interest rates lower.

- Online Lenders: Some online lenders focus on offering loans to those with bad credit. These may come with a higher interest rate, but also come with more lenient credit score and loan amount requirements.

- Home equity loans: If you own your home outright or have a good amount of equity, a home equity loan or line of credit (HELOC) might be a feasible option. These loans are secured by the equity in the home, which reduces the risk to the lender and may even result in better loan terms, even for borrowers with poor credit.

- Secured Loans: Some banks might provide secured loans for home modifications, in which the borrower can use an asset — like a vehicle — as collateral. It carries the risk of loss of the asset in case of default.

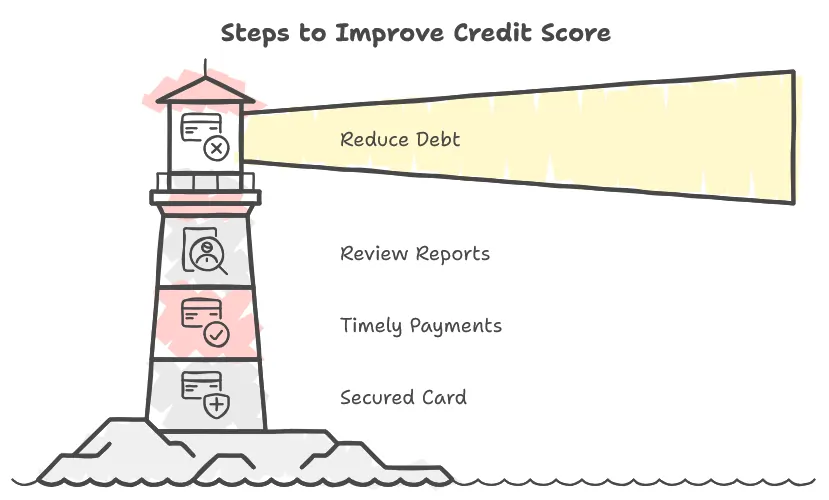

Credit improvement strategies

It is a must that bad credit persons who want to qualify for a better loan should be working on their credit score. Some strategies include:

- Reduce outstanding credit card balances and other debt to improve credit score and to demonstrate good borrowing.

- Reviewing Credit Reports: Checking for errors on credit reports and disputing them also can help increase the score.

- Timely Payments: Paying a bill on time (and paying all your bills) over time maintains (or improves) a credit score.

- With Secured Credit Card: Secured credit card account opening: With that, making timely payments can help experience building credit.

It takes a while to improve credit, but even small improvements can result in more favorable loan options and lower interest rates.

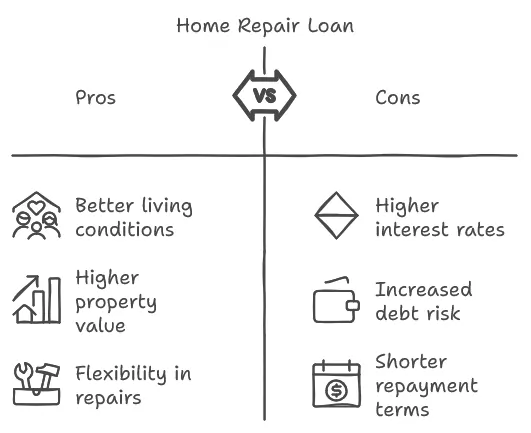

Home Repair Loans For Bad Credit: Pros And Cons

Pros And Cons Of A Home Repair Loan Before Choosing To Apply

Pros:

- Better Living Conditions: Access to funds to make home repairs could improve your living conditions for the better.

- Higher Property Value: Maintaining a house well subsequently retains its worth, which can assist increase resale worth, in the occasion you make a decision to sell the house within the future.

- Flexibility in Repairs: Home repair loans can cover various repairs and improvements from plumbing to roofing to electrical upgrades.

Cons:

- Impact of Higher Interest Rates: High interest rates can result in costlier repayments in the long run for the individuals who have poor credit.

- Likelihood of Increased Debt – If the homeowner cannot pay it back, then they have just put themselves in a position where there are even more financial worries or a lower credit score.

- Shorter Repayment Terms: Certain bad credit loans have shorter respayment terms. While these loans are paid back quickly, the monthly payments can be significantly more than the borrower can manage comfortably.

Home repair loans for bad credit are a potential way to keep a roof over your head and a home in good shape, but they aren’t without risk. Borrowers need to consider the pros and cons before applying. HomeRepairLoan The content is developed from sources, including but not limited to, the company website or other resources used for the home repair loan. Bad credit repair, if you are patient enough, can do wonders when it comes to getting better loans in the future.