When it comes to buying or selling your home, knowing your mortgage options can make all the difference in the world. The one term that continues to become relevant is the Assumable FHA Loan. But what does it mean exactly, and how can it help buyers and sellers? In this guide, you’ll learn exactly what Assumable FHA Loans are, how they work, and why they may be the right choice for you.

Don’t feel like reading? Listen to our podcast on the topic to get the answer to your question.

What is an FHA Loan?

Assumable FHA loan tips — But first, what is an FHA loan? FHA Loans — backed by the Federal Housing Administration (FHA), FHA loans are intended to help low to moderate-income buyers have better access to homeownership. They typically feature:

- Lower down payment requirements (as low as 3.5% ).

- Expanded flexibility with credit score requirements.

- Interest rates are lower than conventional loans.

These loans can be especially compelling if you’re a first-time homebuyer or if your credit isn’t pristine.

What is an Assumable FHA Loan?

A lease-Assumable FHA loan is a mortgage that can be taken over, or “assumed,” through the current homeowner’s home to the buyer when the home is sold. The buyer can instead “assume” the original FHA loan of the seller, including its interest rate, terms and balance, rather than applying for a new mortgage. If the originating loan has good terms, this can be a win-win for both sides.

Translated to layman’s terms, an Assumable FHA loan means a buyer can take over a seller’s loan – potentially with a better interest rate than what they’d find on the market these days. This can be a very appealing feature that makes homes with Assumable FHA loans more desirable for potential buyers.

How Does an assumption of an FHA Loan Work?

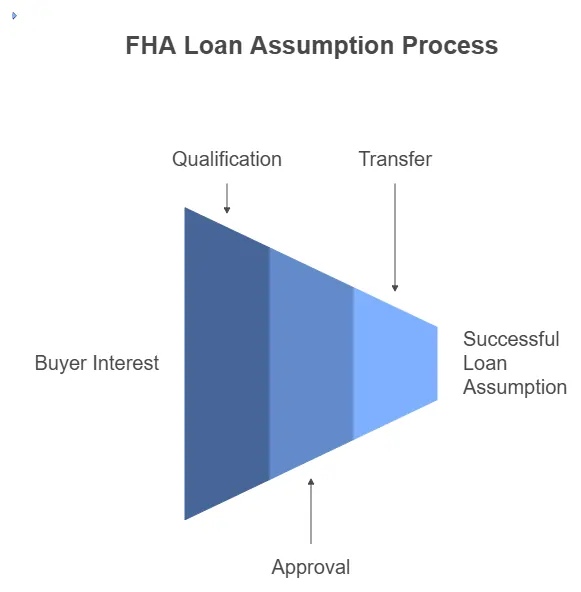

The process of taking over an FHA loan is as follows:

- Qualification: The buyer needs to qualify for an FHA, which means the buyer’s got to have an A1 credit score, a job, and the ability to pay monthly payments.

- Assumption approval: The buyer’s taking over the loan must be approved by the seller’s lender. Similar the mortgage process you get approval.

- Transfer: If the assumption is acceptable, the buyer assumes the current loan and continues to make payments under the seller’s terms.

The Advantages of Buying an Assumable FHA Loan

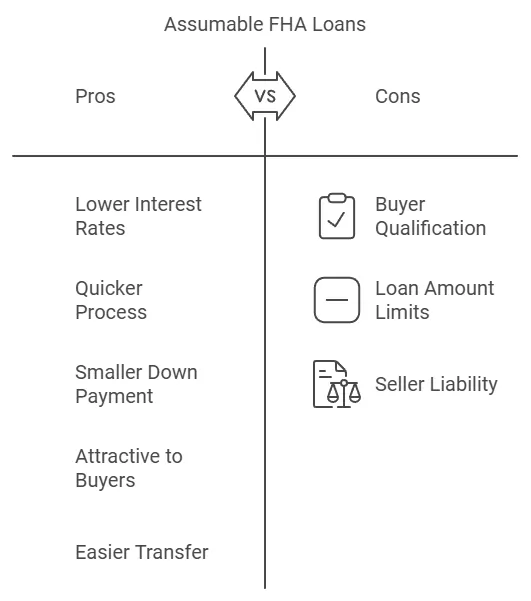

There are a few reasons that might incentivize buyers to ring your home with Assumable FHA loans:

- Lower Interest Rates: If the seller locked in an interest rate when they took out the loan, the buyer can keep making payments at that interest rate, even if current market rates will be higher.

- Quicker & Less Complicated Process – An assumption may take less than applying for a brand-new mortgage

- No Need for a Big Down Payment: If the buyer qualifies with the FHA, they may not have to pay in as much money as they would for a conventional loan.

Benefits for Sellers

It’s not just buyers that can benefit from an Assumable FHA loan — sellers can too:

- Alluring Selling Proposition: A more attractive interest rate can help the home attract buyers, thus increasing the saleability of the property.

- Easier Transfer: If the buyer can assume the loan, the seller won’t have to jump as many frenzied transfer hoops.

Are There Any Drawbacks to Assumable FHA Loans?

But while there are evident pros, there are also a couple of things to be aware of:

- Not All Buyers Will Qualify to Assume an FHA Loan. The buyer would also have to fulfill various credit and financial requirements.

- Loan Amount Limits : The FHA sets limits on how much it will insure for a given home based on the region.

- Seller Liability: Under certain circumstances, the seller could also be liable for the loan of the buyer, even after transferring the loan, unless the buyer gets a “novation” — a legal document that relieves the seller of future liability.

The Assumption Process: What to Do

Here’s how you can take over a FHA loan:

- Talk About the Option: For buyers: Talk to the seller about whether their FHA loan is assumable.

- Apply for assumption: The buyer contacts the lender to apply for the loan assumption, wherein they’ll need to submit financial information including income, credit score, and debt-to-income ratio.

- Lender Approval: Lender approves/denies the assumption

- Complete the Transfer: If approved, you will assume the loan, and you will hand over the responsibility.

Assumable FHA Loan vs. Other Mortgage Types

Conventional Loans vs FHA Loans: Conventional loans are not assumable, whereas, FHA loans typically are. This means that buyers who are considering taking over a mortgage would be better served seeking out an FHA loan if they want favorable loan terms.

VA Loans: Like FHA loans, VA loans (for veterans and service members) can also be assumable. But they come with their own eligibility and benefits.

Is an Assumable FHA Loan the Right Choice for You?

For buyers, taking over an FHA loan may be the best way to take advantage of lending conditions where interest rates are low, and mortgages are affordable. But make note: Not all FHA loans are assumable, and a buyer may need to meet certain requirements.

Sellers may find the option of an Assumable FHA loan attractive in terms of marketing the sale of a property, but it is essential to understand the potential risks involved in this transaction — including assuming the original owner’s liability — and the requirement to work with only a qualified borrower.

Conclusion

In a nutshell, an Assumable FHA loan is a great tool that empowers you to assume an existing FHA mortgage, often at a lower interest rate and less complicated financing. Sellers can use an Assumable FHA loan to increase interest in their property. But both sides ought to completely digest the process and the requirements to ensure that it’s the best option for their situation.