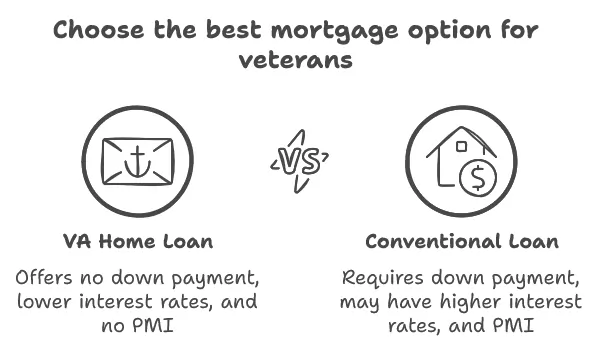

A VA home loan is a government-backed mortgage specifically for veterans, active-duty military members and their families. Another the major advantage to the VA Home loan is that there is no requirement to have Private Mortgage Insurance (Pmi) that comes standard in most Conventional Loans. This article delves into the benefits of a VA home loan with no PMI, the eligibility, how it can help veterans and military families to own a home.

If you are not in a reading mood then no problem! Listen to our podcast for the answer to your question.

What is a VA Home Loan?

A VA home loan is a mortgage provided by an approved lender that is backed by the U.S. Department of Veterans Affairs. It’s meant to assist veterans, active-duty service members and some members of the National Guard and Reserves in purchasing homes with favorable terms. VA Home Loan Benefits and Features

- No Down Payment: Qualified borrowers can often cover the full purchase price of a home.

- Competitive Interest Rates: VA loans often provide lower interest rates than conventional loans.

- No PMI Requirement: Without a doubt, this is one of the very best features as just about all conventional loans show PMI if the borrower doesn’t put 20% or more down.

What is PMI?

What is Private Mortgage Insurance (PMI)? In most conventional loans, the borrower will pay for PMI if their down payment is under 20%. PMI raises the borrower’s monthly mortgage payments, frequently tacking on hundreds of dollars to the price of the loan.

No PMI Required For VA Home Loans

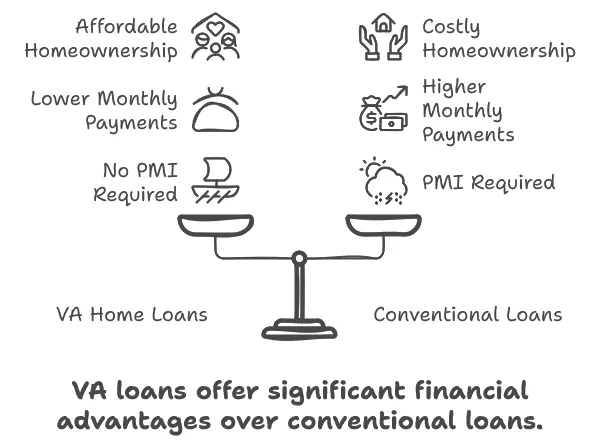

The biggest upside of a VA home loan? You don’t pay PMI. This is due to the VA guaranteeing part of the loan, lowering the risk for lenders. With no PMI required, the VA loan allows veterans and military families to make homeownership more affordable by lowering the borrower’s total monthly payment.

- Lower Monthly Payments: Veterans experience a decrease in their monthly mortgage payments without PMI.

- Lower-Cost Homebuying: When you don’t pay PMI, that money can be used for other expenses — home repairs, education or retirement savings.

- No PMI (Private Mortgage Insurance): With conventional loans, if you’re down payment is less than 20%, you may have to pay PMI, which acts as precautions to the lender — with VA loans though, you do not need PMI, making it more affordable long-term.

How to Get a VA Home Loan Qualifying

[6:29 AM] THE OUTLINE: [VA home loan eligibility, eligibility requirements & income calculation] These criteria are generally based on military service, although they may in some cases include a veteran’s surviving spouses.

Requirements Include the Following:

- Veterans: Generally, veterans who served 90 consecutive days in wartime or 181 days in peacetime qualify.

- Active Duty Service Members: Service members who have been on active duty for a minimum of 90 continuous days.

- Members of the National Guard and Reserve: Members may become eligible after serving 6 years in the National Guard or Reserve.

- Surviving Spouses. Spouses of veterans who were killed in action or who died from a service-related disability may qualify for a VA loan.

In addition, applicants must meet specific credit and income requirements established by the lender, and the property being bought must meet the VA’s standards for livability.

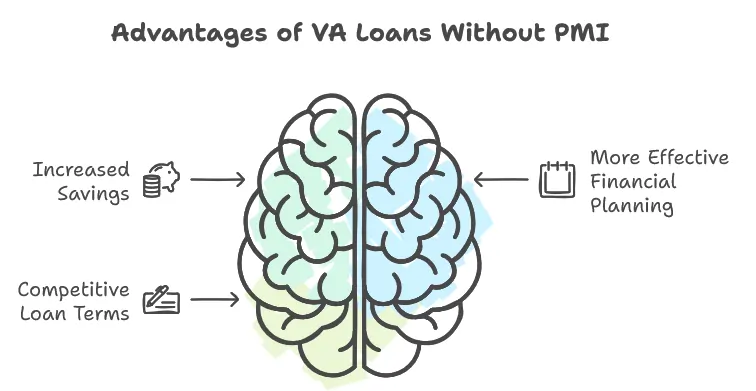

Pros of a VA Loan With No PMI

- Increased Savings: The borrower’s monthly mortgage payment without PMI is usually less than a conventional loan.

- More Effective Financial Planning: By removing the payment of PMI, borrowers can plan their finances more flexibly, directing money to other means (e.g., savings, home improvement).

- Competitive Loan Terms: VA loans are often competitive in terms, also typically offering lower interest rates, further lowering the overall cost of a long-term mortgage.

Challenges and Considerations

Though VA loans are advantageous, challenges and considerations exist:

- Eligibility Requirements: Veterans or active-duty service members must complete certain service requirements to qualify, which may disqualify some individuals.

- Funding Fee: Although PMI is not required, VA loans do incur a funding fee that helps to defray the costs of the program. This fee can be included in the loan amount, though, so it doesn’t have to be paid upfront.

- VA Limits: The property being bought has to be to VA standards for basic safety and livability, which can limit some options for homebuyers.

VA home loan lets you skip PMI, which can mean lower monthly payments and more home for less cost for veterans and military families. Best of LuckProspective homebuyers should take care to do their research and understand the eligibility requirements and benefits of this loan so that service members and veterans can make the right home financing practices for their situation. It is additionally a good idea to speak to an economic consultant or VETERAN LOAN expert, to guarantee you are completely familiar with the process and that you obtain the best outcome when buying the residence.